- About Us

- Farm Store

- Belle's Barber Shop

- Media

- Fuel Prices

- Cash Dividend History

- Location Map

- Contact Us

- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Hedging Resource Center

- Farmer's Almanac

- USDA Reports

Old Dominion Freight Line Stock: Is Wall Street Bullish or Bearish?

/Old%20Dominion%20Freight%20Line%2C%20Inc_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Thomasville, North Carolina-based Old Dominion Freight Line, Inc. (ODFL) is one of the largest North American less-than-truckload (LTL) motor carriers and provides regional, inter-regional and national LTL services. With a market cap of $36.3 billion, Old Dominion’s offerings also include various value-added services, including container drayage, truckload brokerage, and supply chain consulting.

The company has notably underperformed the broader market over the past year. ODFL stock has plunged 7.6% over the past 52 weeks and 3.7% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 11.5% gains over the past year and a marginal 60 bps uptick in 2025.

Narrowing the focus, ODFL has also lagged behind the iShares Transportation Average ETF’s (IYT) 1.5% gains over the past year and a marginal 10 bps uptick on a YTD basis.

Old Dominion’s stock prices observed a marginal uptick after the release of its better-than-expected Q1 results on Apr. 23. Due to the persistent softness in the macro environment, ODFL has continued to observe a decline in volumes. This has led to its topline declining 5.8% year-over-year to $1.4 billion, but this figure surpassed the Street’s expectations by 50 bps. Meanwhile, the company also observed a notable contraction in its margins, leading to its net income for the quarter decreasing 12.9% year-over-year to $254.7 million. However, its EPS of $1.19 surpassed the consensus estimates by a notable 3.5%.

For the current fiscal year 2025, ending in December, analysts expect ODFL to deliver a 4.9% year-over-year decline in earnings to $5.21 per share. On a more positive note, the company has a promising earnings surprise history. It has met or surpassed the Street’s bottom-line projections in each of the past four quarters.

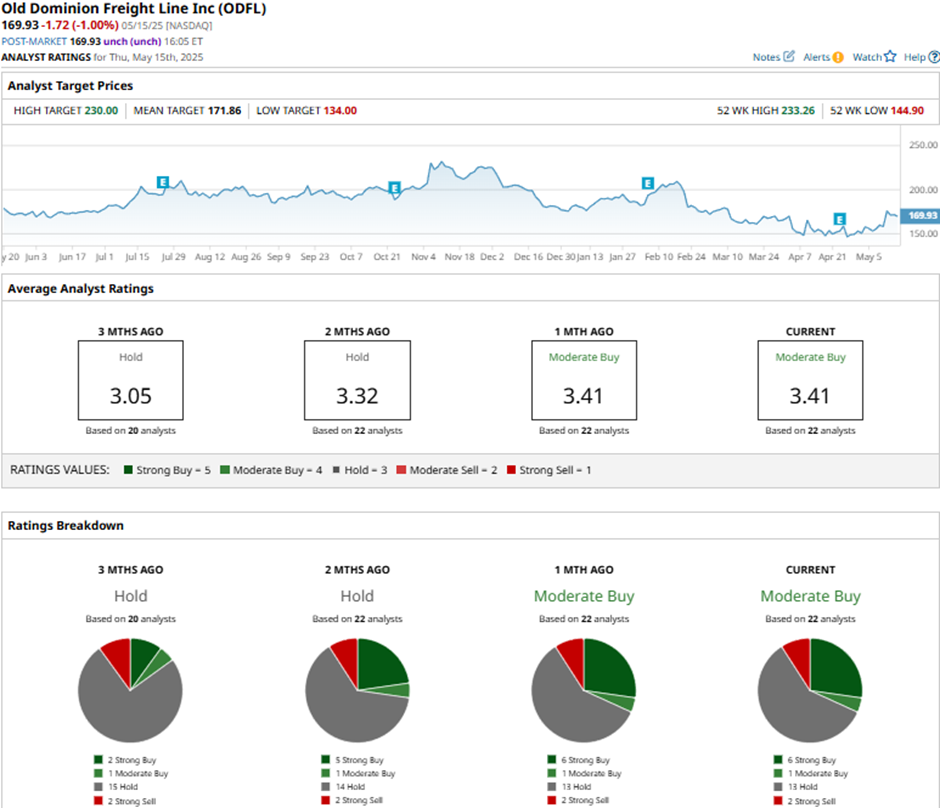

The stock holds a consensus “Moderate Buy” rating overall. Of the 22 analysts covering the stock, opinions include six “Strong Buys,” one “Moderate Buy,” 13 “Holds,” and two “Strong Sells.”

This configuration is notably more bullish than three months ago, when the stock had a consensus “Hold” rating overall. Moreover, only two analysts gave “Strong Buy” recommendations.

On Apr. 24, Truist analyst Lucas Servera reiterated a “Buy” rating on ODFL, but lowered the price target from $220 to $175.

While ODFL is currently trading slightly below its mean price target of $171.86, the street-high target of $230 indicates a staggering 35.3% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.